Our Investment Committee identifies a chart each month to highlight some of the most pressing topics in the investing world. Charts help illustrate trends and are a great tool for predicting what we may see in the near future. Browse our past investment charts and be sure to follow our social media accounts for the most current chart releases.

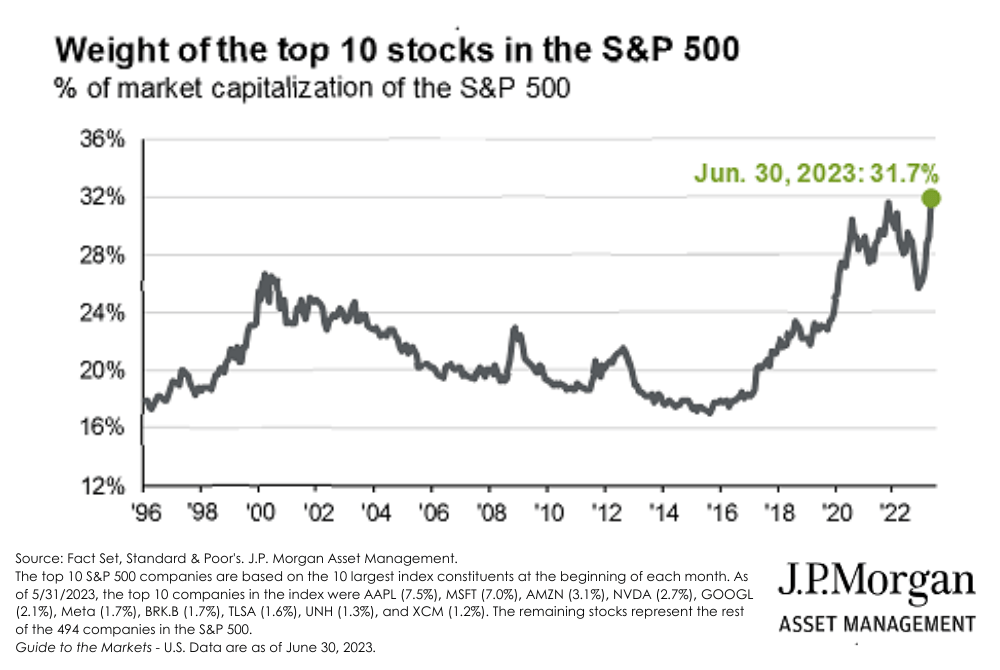

For the first half of 2023, the market has had a good run providing some recovery from last year’s losses. In this month’s chart, @JP Morgan Asset Management illustrates just how crucial the top ten stocks have been in fueling the S&P 500’s gains thus far. While the spotlight shines on these leading stocks, we’re eager to see if other sectors are ready to step up to the plate and continue on this pattern of growth.

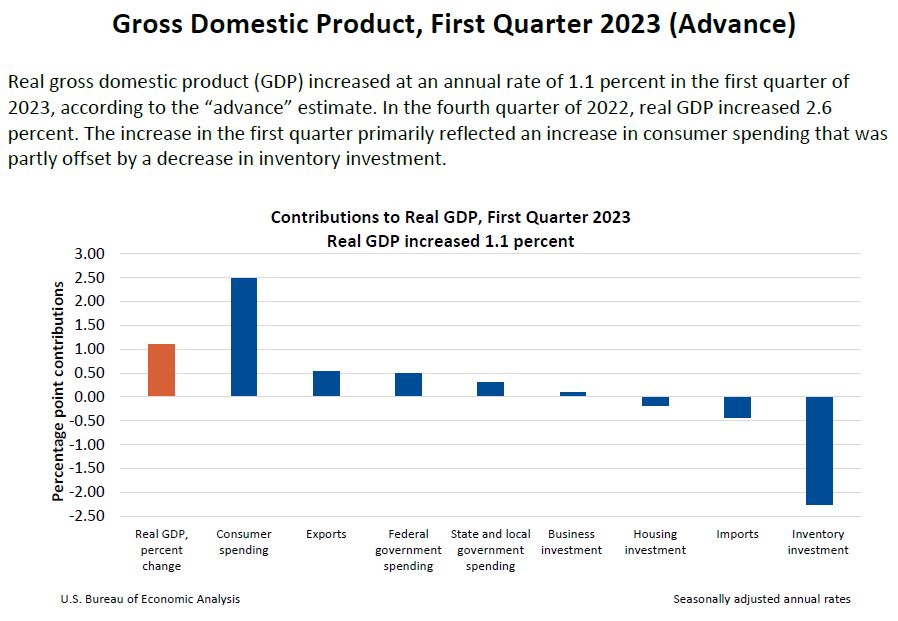

The Bureau of Economic Analysis released its latest report on Gross Domestic Product (GDP), and it’s showing some interesting trends. Real GDP increased at an annual rate of 1.1% in Q1 2023, compared to the previous quarter’s increase of 2.6%. What does this mean? It looks like the Federal Reserve’s tightening cycle is doing its job of slowing growth in the economy.

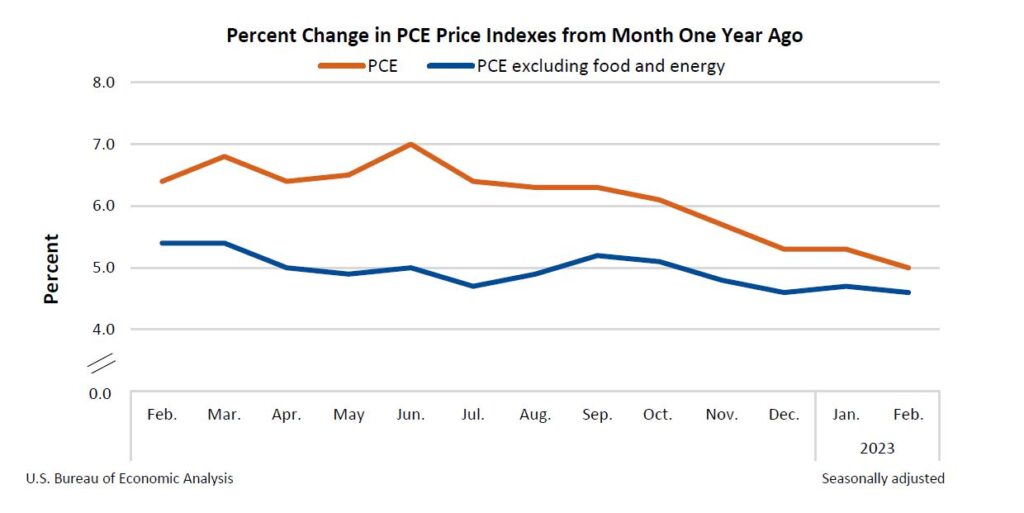

The Personal Consumer Expenditures (PCE) price index for February was up 5% from last year, 4.6% if you exclude food and energy. Although these numbers have risen, the rate of growth was still slightly lower than predicted – suggesting that Federal interest rate hikes may be doing their job when it comes to reducing inflation. These figures sparked optimism with the possibility of ending the interest rate hikes on the horizon.

After a volatile 2022, the stock market’s positive returns in 2023 thus far offer a welcome relief to investors. The Fed’s 25 basis point hike at the beginning of the month signals that progress is being made towards cooling inflation, leading investors to rejoice and continue lifting the stock market even higher. “Don’t Fight the Fed” may now be a positive for stocks as lower rate increases may outweigh recession risks.

In our latest investment chart of the month, we doubled down and included a side by side of two different inflation charts. The chart on the left shows that inflation on goods has come down from its peak in 2022 as inventories have begun to stabilize and oil and gas prices have dropped considerably. This downtrend in goods inflation is great news, but shelter costs (i.e. wages/housing/rent/etc.) continue to climb and the labor market remains tight, driving up wages. The chart on the right does offer some hope in that there are indications that the peak is not far away and could turn by mid-2023.

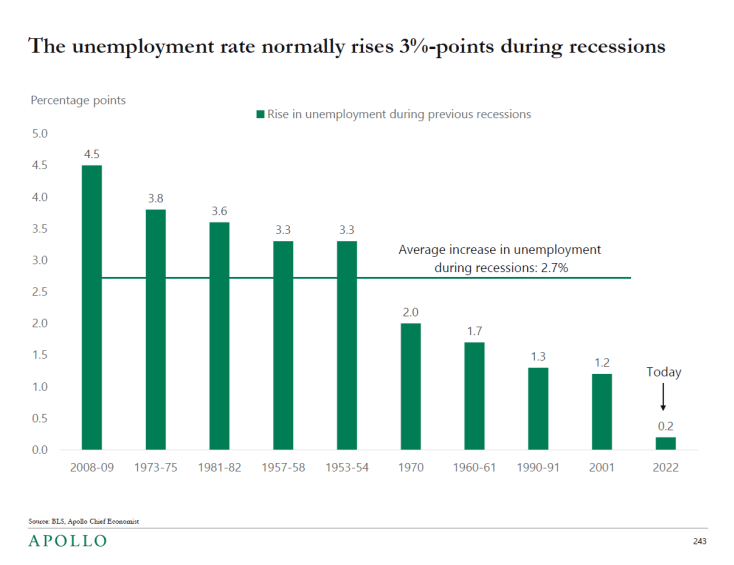

Talk of a recession has been looming for several months now, but the current unemployment rate paints a different picture. Typically during recessionary environments we see a 2.7% increase in the unemployment rates, but as of today we are sitting at about 0.2%.

With a lot of uncertainty in the markets, one thing is for sure, bonds look much more attractive than they did at the beginning of the year. Check out this month’s investment chart for an overview of how bonds have fared over the years.

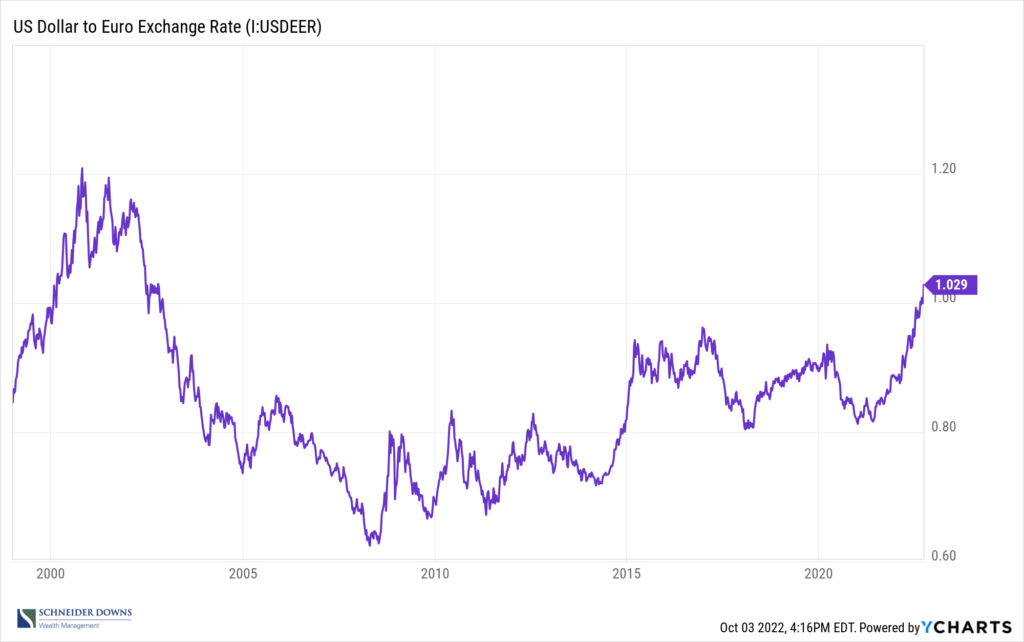

For the first time since the early 2000’s, the USD to Euro exchange rate has become more favorable, making now a better time than ever to go on that trip abroad you’ve been dreaming of! The USD has been rising steadily for the last couple years, which begs the question, how long do we think this strong dollar will continue? Take a look at the chart to see how the exchange rate has trended over the years.

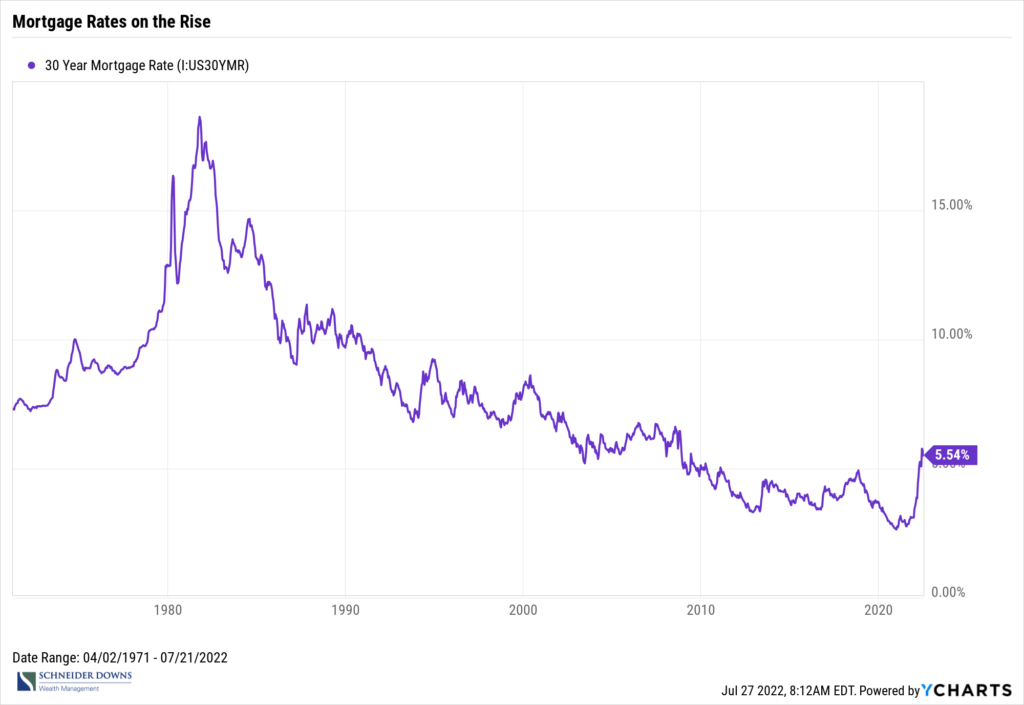

Buying a home is huge. When you’re trying to build your family, your financial stability and your credit, it can be nerve-wracking. The housing market is not looking great with the highest rates on mortgage loans since the Great Financial Crisis. From a high of 18.63% in the 1980s to a low of 2.65% in 2021, it is clear that mortgage rates are on the rise. Check out this chart for insight on how the rates have trended over the past 50 years.

Receive all the latest insights and industry tips.

Email us: sdwealthmanagement@schneiderdowns.com

Schneider Downs Wealth Management, LP (“SD Wealth Management” or “SDWMA”) is an SEC Registered Investment Advisor specializing in the Investment Management and Financial Planning Services for Individual Investors; Investment Management and Investment Committee Services for Institutions and Non-Profits; and Corporate Solutions and ERISA Fiduciary Services. Registration with the SEC does not imply any level of skill or training.

© 2024 Schneider Downs & Co., Inc. Maryland license number 35239.

Gain access to exclusive content from our team of advisors.

Interested in receiving the latest updates from our investment team on what’s going on in the markets? Or maybe you could use some information on the fundamentals of building a successful financial plan. Sign up today to stay in the know!